As swine producers, you all pay a health tax at the end of the year, whether you know it or not. This tax is paid on every pig and reflects the cost of less-than-perfect health in an operation. The health tax is often far larger than producers recognize and is consistently evident year after year in the FarmStats data. At PIPESTONE, we believe there are ways to help significantly reduce this health tax and it starts with recognizing a change in how decisions are made and how they impact farms. Decisions to first and foremost optimize health result in lower health tax and a new way of thinking. This is what we are calling A New Health Paradigm.

As swine producers, you all pay a health tax at the end of the year, whether you know it or not. This tax is paid on every pig and reflects the cost of less-than-perfect health in an operation. The health tax is often far larger than producers recognize and is consistently evident year after year in the FarmStats data. At PIPESTONE, we believe there are ways to help significantly reduce this health tax and it starts with recognizing a change in how decisions are made and how they impact farms. Decisions to first and foremost optimize health result in lower health tax and a new way of thinking. This is what we are calling A New Health Paradigm.

In this article, we will attempt to highlight the key steps to start lowering the health tax which are evident in those producers that have done so through adopting the New Health Paradigm.

Step 1: Pathogens and Disease

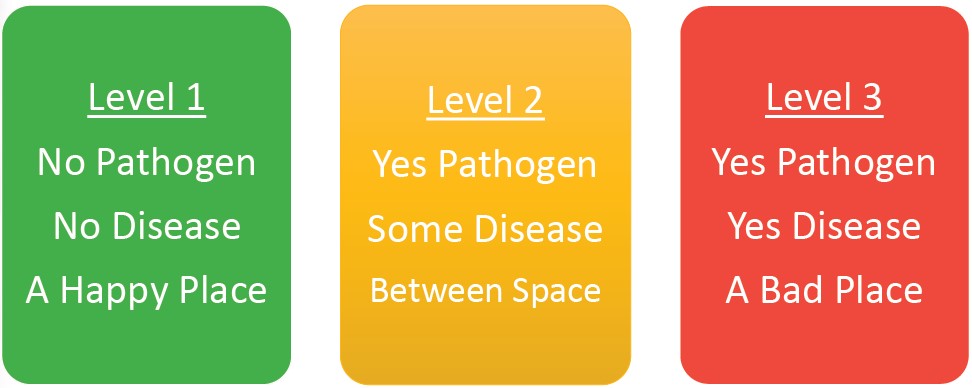

We must start with defining the pathogen and disease status at our sow farm. We complicate things with multiple different “health levels” and classification schemes, but it does not need to be this difficult. In an Easy 1/2/3 system, we can effectively classify and communicate pathogen and disease status.

On a path towards living the new health paradigm, you should strive to have Level 1 sow farms. This must include PRRS, but goes beyond this to reflect the status of Influenza, Mycoplasma, PEDV and bacterial status. We are fortunate that our veterinarians have great tools and methods to help improve the health status for these diseases.

Step 2: System Design

The design of a swine farming operation is highly related to the expected outcomes for health and performance. This goes beyond just simply barn design, referring more to size of sow farm and pig flow, size of wean to market facilities, sow and wean-to-market area density, all-in-all-out by site ability, transportation, personnel and feed mill integration. There is not a perfect design, but there are bad designs or badly designed components that fail to optimize health and raise our health tax.

Step 3: Wean-to-Market Biosecurity Standards

We are severely lacking on standards for wean-to-market biosecurity that we hold ourselves accountable to. As an industry, veterinarians and farmers have failed to outline standards and commit to adhering to them for wean-to-market sites. We take sow farm biosecurity to the highest level and have improved infection rates over time because of this. It is time to define, invest, commit and audit to a new set of standards for wean-to-market biosecurity that will improve health.

Step 4: Mitigate Risk

We have better tools and better data today than we have ever had to help mitigate disease risk and we should use these tools. Between air filtration, feed mitigation, vaccines and others, we should use those tools at our disposal when appropriate to lower health risk to our farms.

Step 5: Hire a Good “Accountant”

Every farm has a skilled accountant (often more than one) that helps to identify all the areas to try and lower the taxes paid. This should be true in lowering the health tax as well. There are different areas that contribute to the health tax paid that you may not consider; genetics, nutrition, management and marketing can all be areas that have influence on your health tax. Think outside of the box and make sure you have a good “accountant” when evaluating your health tax strategy.

Old paradigms are changing and the New Health Paradigm is shaping farms for the future. PIPESTONE is here to help you look at these key areas for “health tax planning” for your future and start moving toward a New Health Paradigm.

By: Dr. Adam Schelkopf, Health Director, Veterinarian Pipestone Management